Why Gold?

Gold has been on a tear, up 53% since the start of 2024 as of March 31st. In 2025 it hit a year-to-date high up 30% in mid April. But that’s not why it’s one of the assets we chose to be part of the ForAll Core & More U.S. Equity Index, and the FORU ETF. Why did we choose gold? Because there is potential that having gold in the ETF will reduce downside if markets drop and can provide positive returns if markets rise.

Gold has typically been seen as a haven during times of market uncertainty because returns have low correlation to stock market returns, meaning that movements in stock markets are not related to moves in the price of gold. Since 1980, the correlation between gold and the S&P 500 is almost zero at 0.01. The following table shows how gold is correlated with other major North American Indices, the S&P/TSX has the highest correlation given the number of gold mining companies listed on the exchange.

Central banks generally buy gold as a store of value, it’s a hedge against inflation and currency devaluation and considered a safe asset during uncertain economic times. Central banks have been buying record amounts of gold over the past 3 years helping drive the price increase. The World Gold Council reports that central bank purchases have topped 1000t each of the past 3 years, averaging net purchases of 1058t over that span. This easily passes the average annual purchases between 2010 and 2021 of 481t. We are likely to see some mean reversion in gold purchases in 2025 as it’s unclear if banks can keep up the pace of buying we’ve seen over the past few years, but it’s safe to say the global economy has not become more stable since the start of 2025.

Why does the FORU ETF occasionally shift from equities to gold?

Gold is a great diversifier. A discussed above, it has almost zero correlation to equity markets, but we know that most asset classes tend to be more highly correlated during major downturns, or tail risk events. Correlations during tail risk events tend to be much different than during normal market conditions and prudent risk management says you should focus on tail events to avoid catastrophe. So how does the gold – S&P 500 correlation look over the worst periods for equity markets?

Since the start of 2007, during the worst 5% of daily S&P 500 returns (tail events), the correlation with gold is slightly negative at -0.015, a move in the right direction. During the 5 most recent major drawdowns for the S&P 500, gold has had a better return in all of them beating the S&P 500 by an average of 35% over these stretches and posting a positive return in 3 of the 5 downturns.

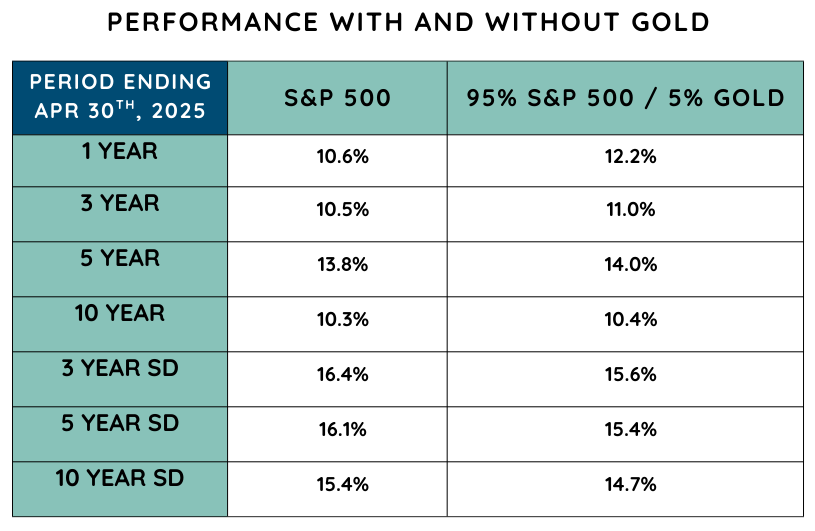

Indeed, gold is a good diversifier and risk management tool during tail risk events and can help your returns over those periods. But it won’t always help your returns. The following table shows how a 5% allocation to gold would have helped returns and lowered standard deviation for the period ending April 30th, 2025.

But if you look at the decade of the 2010s as an example, the 5% allocation to gold would have slightly hurt returns over most time frames.

How does gold fit into the FORU ETF?

The FORU portfolio is constructed using a rules-based algorithm (you can read more about why, here). The rules are based on market factors like momentum and volatility, and they are designed to capture as much upside as possible when markets are strong and attempt to limit the downside and protect losses when markets are weak. In a nutshell, the rules-based algorithm allows the ETF to take an aggressive stance, a defensive stance, or a very defensive stance. The defensive stance is where gold comes in.

One of the rules dictates that when market volatility increases to a specific level, the portfolio shifts to a defensive position by adding gold exposure and reducing equity exposure. That’s what happened at the beginning of April. The target allocations for the ETF are now 50% gold (iShares, Gold Bullion ETF), 30% BetaPro NASDAQ 100 2x Daily Bull ETF (QQU) and 20% SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX) and will remain that way until the signals turn positive again.

The intent is that the allocation to gold helps reduce the downside and offset the losses in the equity markets. The remaining allocation to the NASDAQ and S&P 500 provides the potential for upside if the markets recover quickly.

We think this diversification will help investors through volatile markets.